|

Algeria

Angola

Benin

Botswana

Burkina Faso

Burundi

Cameroon

Cape Verde

Central Afr. Rep.

Chad

Comoros

Congo (Brazzaville)

Congo (Kinshasa)

Côte d'Ivoire

Djibouti

Egypt

Equatorial Guinea

Eritrea

Ethiopia

Gabon

Gambia

Ghana

Guinea

Guinea-Bissau

Kenya

Lesotho

Liberia

Libya

Madagascar

Malawi

Mali

Mauritania

Mauritius

Morocco

Mozambique

Namibia

Niger

Nigeria

Rwanda

São Tomé

Senegal

Seychelles

Sierra Leone

Somalia

South Africa

South Sudan

Sudan

Swaziland

Tanzania

Togo

Tunisia

Uganda

Western Sahara

Zambia

Zimbabwe

|

Get AfricaFocus Bulletin by e-mail!

Format for print or mobile

Africa: Why Mining is Hard to Tax

AfricaFocus Bulletin

November 12, 2018 (181112)

(Reposted from sources cited below)

Editor's Note

"In Africa as elsewhere in the world, while energy companies might be somewhat undertaxed,

mining companies typically are greatly under-taxed. Indeed, it is only a

slight exaggeration to say that, with a few significant exceptions, notably

Botswana’s diamond mines, mining in Africa is barely taxed at all. One reliable

source indicates that contemporary African governments collect about 55% of the total

value of energy production in tax revenue, but only 3% of the value of mining

production." - Taxing Africa

Taxing Africa, published earlier this year by Zed Books in London, is

being launched in Washington, DC on November 16 by a coalition of civil society

organizations, including the International Centre for Tax and Development

(http://www.ictd.ac/), with which the authors are affiliated. See

http://tinyurl.com/ybezqa39 for more information on the launch and the ICTD web site

for much additional background and resoources.

Tax is a complex issue and it is easy to get lost in the detail. But the consequences

are fundamental for development and human welfare around the world. This new book

provides a comprehensive approach, highlighting not only the often-publicized abuses

by which the rich and multinational corporations evade and avoid taxes, but also

practical steps that African governments can take to ensure that their tax systems

work to provide revenue for the public good.

Based on both first-hand experience and extensive research, the book will be most

useful to those with some background in these issues, particularly scholars,

government officials, and civil society organizations. But it also warrants attention

from anyone concerned about turning critiques of African development into practice,

and is a significant contribution to the growing wider awareness of the centrality of

tax to other policy issues.

This AfricaFocus Bulletin contains an excerpt from this new book on the special

issues in taxing multinational mining companies.

Another AfricaFocus Bulletin released today, not sent out by email but available on

the web at http://www.africafocus.org/docs18/amv1811.php, summarizes the Africa

Mining Vision, by which Pan-African institutions aim to galvanize the transformation

of the mining sector to serve African development.

For previous AfricaFocus Bulletins on taxation and related issues, visit

http://www.africafocus.org/intro-iff.php For the wider range of economic development

issues, visit http://www.africafocus.org/econexp.php

++++++++++++++++++++++end editor's note+++++++++++++++++

Taxing Africa : Coercion, Reform and Development

By Mick Moore, Wilson Prichard, and Odd-Helge Fjeldstad

London: Zed Press, 2018.

Available at https://www.zedbooks.net/shop/book/taxing-africa/ or

https://amzn.to/2JTJzC2

Excerpts from Chapter 5: Extractives and Extraction: Taxing Oil, Gas and Minerals

[used by permission of the publisher]

Let us begin with a good film: Zambia: good copper, bad copper (Public Eye 2012;

https://www.youtube.com/watch?v=uamzirLswjk). Made in 2012, it contains some powerful

campaigning material: large numbers of former mine workers who cannot find jobs in

highly mechanised contemporary mining operations, yet suffer because the industry

poisons their air and water; a transnational mining company (Glencore) that pays

little tax on its Zambian profits; and the callous indifference of some of the people

enjoying these profits – the notoriously wealthy residents of Zug canton in

Switzerland. You might also watch Stealing Africa – Why Poverty? (Guldbrandsen 2013;

https://www.youtube.com/watch?v=WNYemuiAOfU). It tells a similar story.

[Editor's note: For additional selected videos of related interest see

http://www.africafocus.org/docs18/amv1811.php]

In fact, online there are dozens of video clips and countless blog and news items

about the exploitation of Zambia and Zambians by mining companies. Try, for example,

the video in which Anil Agarwal, the boss of Vedanta, one of the world’s largest

natural resources companies, is boasting to Indian business colleagues about how he

obtained his original mining concession in Zambia in 1994 with little money, modest

effort, petty deception, and few future tax obligations (Das 2014). The returns on

his investment have been sky-high. Or look at the wealth of commentary on Chineseowned

copper mines in Zambia, such as China Nonferrous Mining Corporation (CNMC),

Non-Ferrous China Africa (NFCA) and Sino Metals.

Mopani Copper Mine in Zambia. Credit:

http://www.counter-balance.org/mopani-copper-mine-zambia/

Why, in recent years, have journalists and video-makers been so interested in

Zambia’s copper mines, so critical of the mine owners, and so attentive to the

question of how little tax they seem to be paying to the Zambian government? The

answer comes in several parts. Two are specific to Zambia. First, it is one of the

largest mining economies in Africa. Second, there has been a great deal of open

controversy over mining between Zambians: strikes, protests, and electioneering

around employment conditions in the mines, environmental pollution and the small

contribution of mining companies to Zambia’s tax revenues. Global advocacy

organisations have certainly helped stoke the controversies. But the controversies

are rooted in Zambia’s history and politics. During the colonial era, Northern

Rhodesia, as Zambia was then known, was one of the few African countries to host a

large mining industry. Its Copper belt was urbanised, and its trade unions powerful.

The unions were weakened, however, after the mining sector was nationalised in 1969,

international copper prices declined dramatically in 1975, and most mines were

mothballed in the 1980s.

By the mid-1980s Zambia was one of the most indebted nations

in the world, relative to its GDP. Following privatisation, the mines were reopened

on a small scale in the 1990s. At that point few people expected copper prices to

recover to historic levels. There were, however, sufficient residues and memories of

trade union power that the new mining companies – many of them Chinese or Indian –

faced continual political challenges. The companies paid very little for their mining

rights and began to profit very handsomely when world copper prices started to

increase early in this century. Partly because the new mining arrangements were

subject to so much political scrutiny and criticism, the Zambian government has

revised the ways in which it taxes the mining companies several times – but sometimes

it has been forced to retreat in the face of threats from the compa nies that they

would cut back on investment and production.

....

- In fact, it is particularly difficult to effectively and sensibly tax foreign

transnational companies operating in the extractive sector, and even more challenging

to tax companies involved in mining than those extracting energy (oil and gas). The

reasons are many and complex. One purpose of this chapter is to explain them. The

results are that, in Africa as elsewhere in the world, while energy companies might

be somewhat under-taxed, mining companies typically are greatly under-taxed. Indeed,

it is only a slight exaggeration to say that, with a few significant exceptions,

notably Botswana’s diamond mines, mining in Africa is barely taxed at all. One

reliable source indicates that contemporary African governments collect about 55% of

the total value of energy production in tax revenue, but only 3% of the value of

mining production. Bear in mind that, when they collect revenue from extractive

activities, governments are not just taxing value added as they do when levying

corporate income taxes on transport companies or shoe manufacturers. Governments are

also selling national assets: oil, gas or minerals that might otherwise stay

underground and remain part of a nation’s wealth for future use. That figure of 3%

suggests that, in practice, at least some African governments are not selling

national assets to mining companies. They are giving them away.

- The gross under-taxation of mining became especially visible to many observers as

a result of the 2002–10 boom in global commodity prices. The index of global metal

prices, expressed in constant US dollars, almost tripled between 2002 and its peak in

2006 (World Bank 2016b: 1). While prices of copper and other commodities soared,

African governments’ revenues from mining activities increased much more slowly.

‘While the third raw materials super cycle increased the global turnover of the

mining sector by a factor of 4.6 between 2002 and 2010, the tax revenues from the

non-renewable natural resource sector earned by African governments only grew by a

factor of 1.15’ (Laporte and Quatrebarbes 2015).

There are particular reasons why the Zambian mines attract so much attention. But the

underlying problems in taxing the extractive industries are common across Africa –

and, indeed, in lower- income countries generally.

...

Mining activities in Africa are mostly intensely politicised: there is political

conflict over mines, from the exploration stage, before precise locations are even

identified, to the end of their useful life. These conflicts involve shifting

combinations of presidents and ministers, ministries and other public agencies,

exploration companies, mining companies, managers of ports and railways, individual

politicians and bureaucrats, wheeler-dealer local and international businesspeople

and ‘political fixers’, grassroots political activists, small-scale (artisanal)

miners and their representatives, local bandits, lawyers, tax advisers, civil society

organisations, and local and international media. Their tools and tactics are complex

and variable mixtures of secrecy, stealth, public campaigning, bribery, principled

claims, bluff, manipulation, threat, lawsuits, misinfor mation and intimidation.

Anyone who combines an interest in the extractive sector with a taste for drama will

relish the ongoing story of Simandou. Simandou is a mountain range in the deep

interior of Guinea. It comprises so much high-grade iron ore that geologists have

given its peaks names such as Iron Maiden and Metallica. Rio Tinto, the BritishAustralian

mining multinational, was granted exploration rights in 1997. Two decades

later, no significant engineering work has been done. Many sceptics believe that

Simandou will never be exploited. The costs of building the infrastructure needed to

get the ore to the point of export – 650 kilometres of railway, tunnels, bridges, 128

kilometres of road and a new deep-water port – are estimated to be at least twice the

costs of setting up the actual mine. Yet vast amounts of money have been ventured,

won and lost in the course of political manoeuvring over the rights to develop

Simandou. Some advance taxes have even been paid.

Rio Tinto was granted exploration rights to Simandou in 1997. In late 2008, two weeks

before he died, the president of Guinea, Lansana Conté, expropriated half of Rio

Tinto’s rights and awarded them to Beny Steinmetz, an Israeli billionaire who had

made his fortune in the diamond business. Neither Steinmetz nor his business vehicle,

Beny Steinmetz Group Resources (BSGR), which is controlled by family trusts, had any

previous experience in iron ore mining. Contrary to the usual practice, BSGR made no

upfront payment to the government of Guinea for these rights. After about a year,

BSGR sold 51% of its interest in Simandou to Vale, the Brazilian mining conglomerate,

for $2.5 billion – of which only the first tranche was ever paid. There was a brief

period of military rule after Lansana Conté’s death, then free elections were held in

late 2010. The new president, Alpha Condé, had a reputation for honesty. His

government reviewed all the mining licences that Conté had awarded – for Guinea also

has large reserves of bauxite and significant quantities of diamonds, gold, uranium

and offshore oil. Following the review, the Simandou mining rights were returned to

Rio Tinto. At that point, Rio Tinto owned 46.6% of the total rights. Chinalco, a

Chinese state company, was the second largest stakeholder.

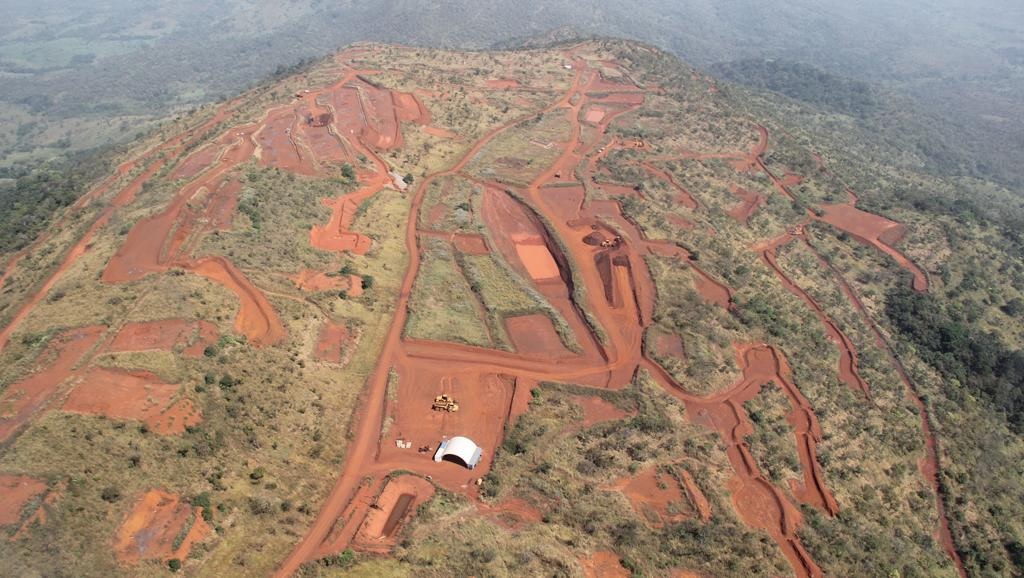

Simandou iron mine in Guinea (Conakry). Credit:

https://ejatlas.org/conflict/simandoun-mine

That is the outline of the plot. The play itself is much more complex and colourful.

Conté’s youngest widow testified that BSGR had offered her millions of dollars,

jewellery, two Toyota Land Cruisers and a 5% stake in the project to persuade her

dying husband to sign over the Simandou rights to BSGR. Among the supporting evidence

was a contract she had signed with the head of BSGR operations in Guinea, in which

she agreed to use her influence to get Simandou mining rights transferred to BSGR in

return for these rewards. This contract for corruption was stamped with the BSGR

corporate seal. Rio Tinto filed a case in the US courts against Vale and Steinmetz

for ‘racketeering’, and alleged that $200 million had been paid to Conté and his

ministers as bribes. The case was thrown out on a technicality in 2015. Meanwhile,

Steinmetz did not give up. He variously threatened or started court proceedings for

defamation against: Global Witness, the London-based advocacy organisation; Mark

Malloch Brown, a former Deputy Secretary-General of the United Nations and a former

UK government minister; Theresa May, the current British Prime Minister when she was

Home Secretary; the UK Serious Fraud Office; and the billion aire philanthropist

George Soros. Vale launched a compensation claim against BSGR. Rio Tinto, too, was

proactive in asserting its rights to Simandou.

In 2011, the company made a payment of $10.5 million to a former top French banker

who had been Alpha Condé’s classmate. When this became public in November 2016, Rio

Tinto immediately dismissed two senior managers who had been involved. Alpha Condé

survived an assassination attempt, and was re-elected president in 2015. But there

were serious accusations of election fraud, and his rule has been marred by violence

and large-scale street protests. Unsurprisingly, both government and opposition

allege that their opponents are working for foreign companies seeking either to

protect their mining rights or to grab a share of those currently belonging to

someone else. The latest twist is that, in October 2016, Rio Tinto agreed to sell its

rights in Simandou to Chinalco, leaving this Chinese company as the dominant player.

The Simandou story is particularly colourful. But it is not unusual.

...

The structure of the extractive industry

There is no single feature of the extractives business that is not found in some

other economic sector. Nevertheless, extractives exhibit such a combination of

special characteristics that the political economy of the sector is quite

distinctive. We list below six of these characteris tics. We then detail five

characteristics of the mining subsector that distinguish it from the energy (oil and

gas) subsector.

- Extractives projects are very dependent on the approval, cooperation and support

of governments. Throughout Africa and in most of the world, sub-soil assets belong to

the state. Without a licence from government, private agents can neither prospect for

sub-soil assets on a large scale nor extract them. Without the approval and

cooperation of government, the extensive infrastructure required – roads, pipelines,

railway lines, ports, offshore drilling rigs, electricity and water supplies – cannot

be put in place.

- Companies that invest in extractives projects are very vulnerable to changes of

policy or attitude on the part of governments. As Rio Tinto found in Guinea, this is

especially true in countries where the law does not rule and where private investment

is so low that governments have few concerns about further discouraging investors by

behaving arbitrarily. In such circumstances, all investors are vulnerable. Investors

in extractives are especially vulnerable for two reasons. One is that the gestation

periods for extractive sector projects are long. Like Rio Tinto in Guinea, companies

can be exploring and planning for decades before they begin to shift any earth. There

is typically an interval of several years between the initial investment and the

point at which a well produces oil or a mine yields saleable coal, copper, zinc or

iron ore. The second cause of vulnerability is that extractives investments are

heavily ‘front-loaded’: the big investments – in exploration, in purchasing

exploration and extraction rights, in setting up the mine or well, and in putting the

associated infrastructure in place – typically are made in the early years, before

the facility begins to produce and generate revenue. Governments therefore face a

continual temptation to agree one set of terms with investors to encourage them to

invest, and then, once they have sunk a lot of money, to offer less favourable terms,

including less favourable tax arrangements. The government of Zambia has changed its

mining tax regime nine times in the last 12 years (Manley 2015). This is sometimes

motivated by high world copper prices and at other times by concerns that the mining

companies will reduce production if taxes are not reduced. In the last resort,

governments can often credibly threaten that mines will be taken over by the state or

given to a different investor, leaving the original investor with huge losses and

debts.

- Natural resource extraction projects often generate large ‘rents’ for the people

who control them: that is, ‘super-profits’ that are higher – and sometimes much

higher – than the combined totals of all production costs and normal profits. For

example, it currently costs around $35 to produce a barrel of oil in Angola (Rystad

Energy 2015). When, in 2014, oil was selling at around $100 a barrel, the government

of Angola was receiving about $65 a barrel in rent. By contrast, in early 2016, when

world market prices briefly fell just below production costs, there were no rents to

collect. Rents are much larger when commodity market prices are high. At any moment

in time, rent levels can differ greatly among mines or wells producing the same

product, because extraction costs will be higher in one mine or well than in another.

Natural resource rents are a major feature of the economy of sub-Saharan Africa: they

account for about one-fifth of GDP. ...

- World market prices for oil, gas and minerals are unstable and tend to fluctuate

in long ‘super-cycles’ of different and unpredictable lengths. This generates major

uncertainties about the likely long-term profitability of individual projects. It

also tends to produce cyclical shifts in domestic public and political opinion: from

anger that extractive companies are not paying more in taxes (when world market

prices are high), to fears that they might close down operations entirely (when

prices are low).

- The information needed to estimate the likely long-term yields, profits or rents

from extractive projects – and therefore to calculate the likely consequences of

different tax arrangements – is typically scarce and unequally available to the main

parties involved. There are several interacting reasons for this, in addition to the

market price uncertainty mentioned above. The basic geological information is

sometimes generated through private surveying and not made publicly available. Even

if available, it may not be very accurate in respect of either the likely quantity

or quality of the product.

- Extractive projects are likely to intrude strongly in the lives of some groups of

ordinary citizens of the host country. Some of the effects might be positive,

including jobs. Historically, mining employed large numbers of manual workers. From

the mid-nineteenth to the mid-twentieth centuries, South Africa’s mines sucked in

migrant labour from throughout Southern Africa. In South Africa and Zambia, as

elsewhere in the world, large mining labour forces were often at the forefront of

trade union organisation. By contrast, Africa’s new mining projects, as well as oil

and gas projects, are highly mechanised – and most of the oil and gas is offshore.

They employ few people. Most wage rewards go to highly skilled expatriates. These

projects provide few employment opportunities to compensate local populations for the

disruptions they suffer, or to assuage their concerns that ‘their’ resources are

being taken from them without recompense. ...

These are the main distinctive features of the extractive sector.

There are then five characteristics of the mining subsector, which are not generally

shared with oil and gas, that help explain why mining in particular is associated

with controversy, corruption and drama.

1. The risk that governments will try to renegotiate agreements in their own favour

is increased because, in mining but not in the energy sector, experience and

expertise in the business are not essential conditions for entry. Beny Steinmetz had

no significant experience of iron ore mining when he bid for the rights to Simandou.

Vedanta, which is now a major global mining company, originated in the scrap metal

business in Mumbai. Because of the high level of politicisation and conflict in the

sector, some operators can be very successful on the basis of an aptitude for the

politics, access to large amounts of capital, and a huge appetite for risk.

‘It’s roulette,’ Steinmetz said; if you work hard, and take risks, you sometimes ‘get

lucky.’ As a small company that was comfortable with risk, BSGR made investments that

the major mining companies wouldn’t. His company lost money in Tanzania. It lost

money in Zambia. But in Guinea it won. (Keefe 2013)

Once entrepreneurs have control of mining rights, they can either sell them on for a

profit to more established and experienced mining companies or buy in the expertise

needed to open and operate mines. It would not be difficult for any government to

find a private company willing to take over a functioning mine if the terms were

right – and even if more established global firms declined to participate. A former

minister of mines in Guinea is quoted as saying: ‘When a new government comes into

power, especially an inexperienced one, there’s one phenomenon that never fails:

every crook on earth shows up. And every crook on earth has the biggest promises, has

access to billions of dollars of lines of credits, of loans’ (Mailey 2015: 53).

2. Mining is more diverse than energy in terms of the range of products produced and

the processes involved in extracting and processing them. The energy subsector

produces only oil and gas, and the range of types of each product is limited. Each

type can normally be identified in terms of one of a small number of standard

reference types – West Texas Crude, Brent Blend and Dubai Crude in the case of oil –

for which there are large, deep global markets and daily posted reference prices.

Miners, by contrast, unearth a much wider range of products including, in sub-Saharan

Africa, bauxite, chromium, coal, cobalt, coltan, copper, diamonds, gold, iron ore,

lead, nickel, platinum, palladium, phosphate, soda ash, titanium, zinc and various

radioactive chemicals and rare earths. Global markets are more fragmented and

diverse. There is less product stand ardisation and less market information.

Governments trying to regulate and tax mining have less access to reliable informa

tion and reliable independent consultants than do governments dealing with energy

companies.

3. Some minerals, including diamonds, gold and palladium, have a high value-toweight

ratio. It is relatively easy for miners to understate production levels and

smuggle product out of the country.

4. These adverse effects of the diversity of the mining subsector are exacerbated by

the near absence, at least in Africa, of an organisational arrangement that is common

in the energy sector: a national oil and gas corporation. These corporations employ

professional staff and, in varying combinations, regulate private sector operators,

own some of their equity, engage in production-sharing agreements, or undertake

exploration, extraction or downstream processing in their own right. These activities

give governments some insight into the logistics and economics of oil and gas

extraction, and thus some capacity to regulate the activities of private companies.

Some governments, including those of Botswana, Guinea, Tanzania and Zambia, own

equity in companies operating mines on their territory. In principle, this is an

alternative way for governments to obtain revenue from mining operations. However,

there is no evidence that, by owning a minority share of the equity in a locally

incorpo rated mining company, governments can prevent companies from engaging in

transfer mispricing and shifting their profits offshore to their parent companies.

Botswana is the exception. The government owns 50% of Debswana, the main diamond

producer, and is generally believed to obtain a fair share of diamond revenues.

5. Joint ventures between two or more large transnational companies (with or without

the participation of the host government) are common in the energy sector but rare in

mining. The energy sector is technically the more demanding. Oil and gas

transnationals enter into unincorporated joint ventures with one another to share

expertise. One of them is responsible for operations and has to report in detail to

the others. This ensures a degree of accounting transparency and accuracy that

reduces the scope for cheating the local tax administration. There are few joint

ventures in the mining sector in Africa.

AfricaFocus Bulletin is an independent electronic publication providing reposted

commentary and analysis on African issues, with a particular focus on U.S. and

international policies. AfricaFocus Bulletin is edited by William Minter.

AfricaFocus Bulletin can be reached at africafocus@igc.org. Please write to this

address to suggest material for inclusion. For more information about reposted

material, please contact directly the original source mentioned. For a full archive

and other resources, see http://www.africafocus.org

|